After 18 Years, Ctrip Was Listed Again, And There Was A Lot Of Guanshan

Strange to say, it's like samsara and fate.

After the SARS outbreak in 2003, Ctrip was listed on NASDAQ. After the new outbreak in 2021, Ctrip was listed on the Hong Kong stock exchange again. On April 19, Ctrip group was officially listed on the stock exchange of Hong Kong under the stock code of 9961. HK, becoming the first online travel enterprise to be listed on both sides.

After 18 years back in the capital market of Hong Kong, Sun Jie, CEO of ctrip.com, said that in the comprehensive analysis of the global GDP trend and prediction, China will be far ahead in the future, and Asia is far ahead compared with Europe and the United States. Therefore, returning to Asia for secondary listing at this time is bound to have a very big role in promoting the development of Ctrip in the next 5-10 years.

"The difference is that, after more than 20 years of development, Ctrip has become a global enterprise with tens of thousands of employees. Our competitors are not in China, but in the world." Liang Jianzhang, chairman of the board of directors of Ctrip group, said that as an international company, Ctrip will continue to improve its global competitiveness after the outbreak.

It's just, "the challenge this time is not necessarily smaller than it was then." Jiang qikang, former Secretary General of the China Tourism Association, believes that the epidemic is much more serious than in 2003, and it is difficult for international tourism to return to the level before the epidemic in two or three years. If only domestic competition intensifies, the challenge to Ctrip will be greater.

Catch up with the tourism hot spots of May Day

At 9:30 on April 19, Ctrip held the listing ceremony of the Hong Kong Stock Exchange at its headquarters in Shanghai, and its app also launched the "online cloud Gong" activity to let its employees and global users watch the whole listing process together.

After the market opened, Ctrip's share price rose nearly 5%. By the end of the market, Ctrip closed at HK $280, up 4.55%, with a market value of about HK $177.2 billion. On the same day, Ctrip shares closed at $36.51, with a market value of $21.945 billion, or about HK $170.4 billion.

The final offering price of Ctrip's international offering and Hong Kong public offering is HK $268.00 per share, with a total of 31635600 ordinary shares. If other factors are not taken into account, the net amount of capital raised by Ctrip in Hong Kong will be at least HK $8.3 billion. The company said it intends to use the net proceeds from the global offering to fund the expansion of one-stop tourism products, improve the user experience, invest in technology to enhance its leading market position in products and services, improve operational efficiency and meet general corporate purposes and working capital needs.

On the same day, with the stock price of Ctrip rising, there are many tourism stocks. Tongcheng Yilong, another travel OTA company with Hong Kong shares, rose 6.5% to close at HK $20, with a market value of HK $43.86 billion. The A-share market is more lively, Guilin tourism, Zhangjiajie and other scenic spots are trading, Tibet tourism, Zhongxin tourism and Xi'an tourism also increased by more than 5%.

The main reason for the carnival of many tourism stocks is that the upcoming "May Day" Golden Week travel and tourism market is extremely hot. It is estimated that the number of tourists is expected to exceed 200 million. The phenomenon of "one ticket is difficult to obtain" reappears in the train ticket market. Compared with 2020 and before the epidemic, the prices of air tickets and hotels have increased significantly, showing a situation of "both quantity and price rise".

According to the 2020 financial report of Ctrip, under the influence of the epidemic situation, the revenue of accommodation booking, transportation and ticketing, tourism and vacation, and business and tourism management of Ctrip's four major business sectors all declined. The total revenue of the whole year was 18.327 billion yuan, and the loss was 3.269 billion yuan, down 49% and 147% respectively on a year-on-year basis.

Jiang qikang believes that due to the long duration of the epidemic, foreign epidemics are still repeated and international travel has not recovered. Therefore, the whole capital market is not optimistic about the tourism industry. Although Ctrip has made great efforts, the proportion of its international business is relatively large and the impact is relatively large.

At present, the overseas tourism market can not do so, and tourism enterprises can only focus on the domestic market. And the domestic market competition is very cruel, "Ctrip's challenge is not in other old online OTAs, but in new competitors, such as meituan, xiaohongshu, shuoyin, etc Jiang qikang pointed out that these apps have huge traffic and high transaction frequency. Although they are not full-time tourists, the tourism business is growing rapidly. However, the opening rate of traditional apps such as Ctrip and tuniu is much lower. After all, tourism is not a high-frequency consumption. Therefore, meituan hit Ctrip, quite a bit of high frequency and low frequency.

This competition has also led to some disputes and discussions in the industry: "is it better to be specialized or to be broad?" Jiang qikang pointed out that Ctrip's crisis at this time was no smaller than when it went public in 2003. Every line of business is facing a lot of challenges.

Responding to disputes

In fact, before the listing of Ctrip, the question about whether the 22-year-old Ctrip can still eat has never stopped.

As Jiang qikang pointed out, Ctrip's rivals in the new era are no longer traditional OTAs, but the flow of Dahu meituan, xiaohongshu and Shuo Yin. In 2020, the revenue of meituan to stores, hotels and tourism will reach 21.25 billion yuan, which has exceeded the total revenue of Ctrip. In addition, according to trustdata, in 2019, the number of nights in meituan hotels has continuously exceeded that of Ctrip, and Q4 has even widened the gap to 1.22 times.

Therefore, in 2020, Ctrip will begin to transform from a trading platform to a marketing trading platform. Ctrip hopes that the content marketing ecology represented by live broadcast, community and star will not only activate the travel inspiration of users, but also break the bottleneck of traffic growth of Ctrip, and provide new value drive for transaction transformation and supply chain empowerment. "Customers really hope to find something, inspiration and one-stop service immediately." Sun Jie said, so Ctrip continues to expand the plate, the current data looks very good, "from the guests come in to find inspiration, find content and their time spent on content double, so we are very optimistic about this piece."

Liang Jianzhang's multi role live broadcast of breaking through the image of senior executives of listed companies, as well as numerous transformation attempts on the platform, let people admire Ctrip's endogenous power from the bottom of his heart, and Ctrip also showed his confidence in its prospectus.

For example, the high net worth user group of Ctrip has always been one of the barriers that Ctrip is proud of. According to the IPO documents, from 2014 to 2019, the compound annual growth rate of consumer users with annual expenditure of more than 5000 yuan was as high as 29%. These high net worth people are also younger. According to Yiguan Qianfan data, 82.2% of the people with medium or above consumption level in Ctrip platform, and 77.7% of the people born after 95-80.

According to the prospectus, more than 40% of the new trading users on Ctrip platform will come from third tier cities and below in 2020. The accelerated growth of new users in low-level cities is in line with the long-term strategic planning of Ctrip, and will also bring new performance growth points for Ctrip. Since the third quarter of 2020, domestic short distance travel and local tourism have become the key driving force of Ctrip's performance recovery. According to the prospectus, in the fourth quarter of 2020, the Gmv of hotels in Ctrip will grow by more than 20% year-on-year, and the number of tickets for scenic spots will increase by more than 100% compared with the same period in 2019. In addition, by the end of 2020, the number of local entertainment suppliers has increased by more than 25% year-on-year.

On the supply side, as of December 31, 2020, Ctrip has cooperated with 1.2 million accommodation partners around the world to provide a full range of accommodation products covering hotels, resorts, residences, apartments, B & B and guest houses; it has cooperated with more than 480 airlines to provide customers with air tickets covering more than 2600 airports in more than 200 countries and regions. It provides more than 310000 kinds of local play products in the world, and has more than 30000 partners in other ecosystems.

It can be said that Ctrip has the strongest and widest supply of tourism upstream and downstream resources in China, which can provide tourists with multi-level services, so it can also build service competition barriers.

Jiang qikang thinks that Liang Jianzhang, the leader of the fire brigade, has saved very well. Before the epidemic, Ctrip's market layout was not limited to China, but developed internationally. It can be said that Liang Jianzhang has a good vision in the international market layout. Without the epidemic situation, Ctrip may become another Ctrip. But unfortunately, the epidemic has come, and international tourism has not recovered to the level before the epidemic in two or three years. "If Ctrip is limited to domestic development, it will be difficult, and the content transformation is very difficult." Another industry expert, who declined to be named.

Can the second listing of Ctrip reproduce the brilliance of the first listing? It may take time to answer.

- Related reading

From Inventing Flash Memory To Having Only One Seedling, What Has Japanese Storage Companies Experienced?

|

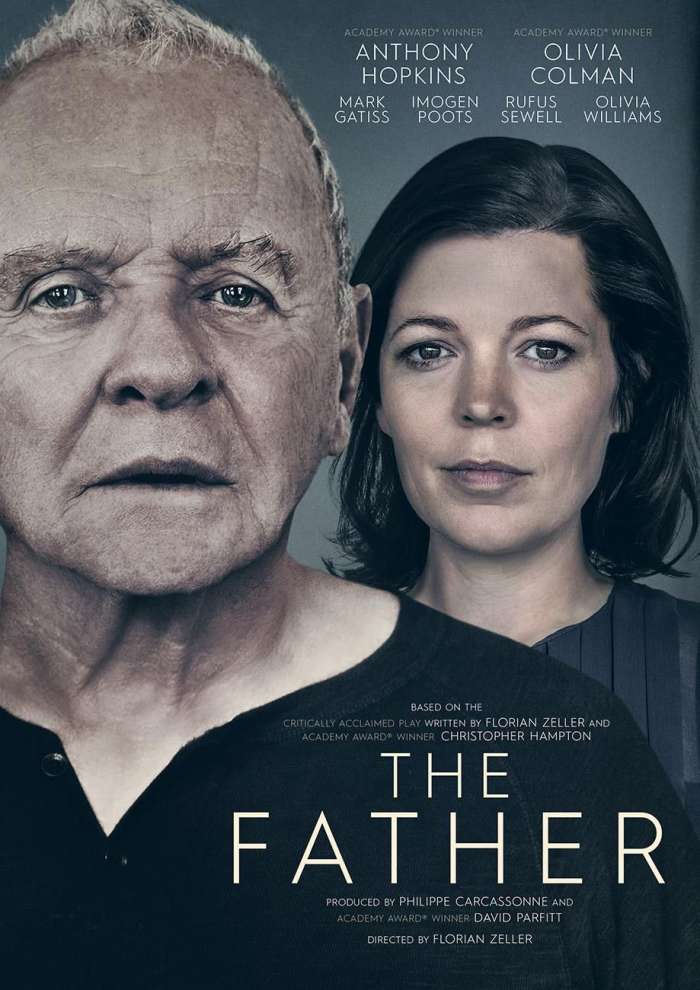

Father Trapped In Time: Seeing The World From The Perspective Of Alzheimer'S Disease Patients

|- Information Release of Exhibition | Nantong International High End Textile Industry Expo Invites The Whole World

- Regional policy | Mayor Ruijin Investigates 9 Textile And Garment Enterprises

- market research | Advantages Of China'S Textile Industry Development Under Globalization

- Fashion brand | Enjoy The New Co Branded Collection Of Supreme X South2wester8

- Regional policy | "Report On The 14Th Five Year Plan" Of Guangdong Garment Industry Released

- Listed company | Forecast Of The First Quarter Report Of The Science And Technology Innovation Board

- Gem | Financial Bureau Sets Up A Platform To Finance "Capital" And "Wisdom" Of 300 IPO Reserve Forces In Shaanxi Province, Outlining The "Hard Core" Layout

- Gem | The On-Site Inspection Of IPO Of "First Brother" Of Futures Industry Completed, And The Net Profit Of Yong'An Futures In 2020 Exceeded 1.1 Billion Yuan

- market research | New Trend Of Star Fund Managers' Position Increase In The First Quarter: Procyclicality And Emerging Industries

- Listed company | The Exchange Pays Attention To The New Measures Of "Shell Protection" Under The New Delisting Rules

- The Third Largest Steel Enterprise In The World?

- Shanghai Rural Commercial Bank Draws Financial Water To Develop "Oasis"

- Qiu Xiandong: FAW Will Continue To Work Hand In Hand With Audi To Create "Audi Golden Decade"

- Qiu Xiandong: FAW Will Continue To Work Hand In Hand With Audi To Create "Audi Golden Decade"

- 2021 The 7Th Wuhan International E-Commerce And "Internet +" Industry Expo

- Nantong International High End Textile Industry Expo Invites The Whole World

- Mayor Ruijin Investigates 9 Textile And Garment Enterprises

- Advantages Of China'S Textile Industry Development Under Globalization

- Enjoy The New Co Branded Collection Of Supreme X South2wester8

- "Report On The 14Th Five Year Plan" Of Guangdong Garment Industry Released