Home >

Analysis Of Global And Chinese Cotton Market Situation

1. The most abundant period of liquidity has passed, and the support for commodities has weakened

After the outbreak of new crown pneumonia, the global economic stimulus policy has brought about currency flooding and a "mirage" of economic growth. Commodity markets generally rose. With inflation rising significantly, the differentiation of global monetary policy has accelerated under the loose tone. Central banks of Russia, Brazil, Hungary, Mexico, Czech Republic and other countries have successively increased interest rates. Canada, Japan and the United Kingdom have reduced the scale of bond purchase. On August 26, South Korea rushed to raise interest rates in Asia. In the year of 021 / 22, the Fed plans to reduce the scale of bond purchasing, and the degree of monetary easing is not as good as before. The rise of commodity markets including cotton is on a slow track.

2. Under the refraction of the external environment, the supporting force of the basic plane decreases synchronously

The year 2020 / 21 is an unconventional year. The loose monetary policy and the short-term rebound of consumption support the sharp rise of the market. However, this force gradually decreases in 2021 / 22, which is mainly reflected in the year-on-year change of consumption. According to the prediction of relevant international organizations, the global cotton inventory consumption ratio in 2020 / 22 is 77.12%, which is 18.35% lower than that in 019 / 20, while the global cotton inventory consumption ratio in 2021 / 22 is expected to be 70.73%, 6.39% lower than that in 2020 / 21. Inventory consumption significantly narrowed than the year-on-year decline, the strength of market support is also weakening.

3. Port congestion impacts the whole industry chain, and the terminal textile and clothing export market has great operating pressure

Affected by the rebound of the epidemic situation, the silting of ports around the world is becoming more and more serious, which impacts the textile and garment industry chain. According to media statistics, the global shipping system is facing the biggest crisis in the past 65 years. The sea freight prices from China, Southeast Asia to the east coast of North America exceeded US $20000 per TEU for the first time. Since this year, the Baltic dry bulk index has risen by more than 180%, reaching a new high in 11 years. Port congestion not only disrupts the normal operation of the global cotton textile industry chain, but also increases cotton prices and sea freight. The bargaining power of terminal domestic and foreign sales orders is weak. Many foreign trade enterprises are besieged. Many export orders are in a dilemma. The downstream pressure of the terminal may eventually force the upstream to cool down.

- Related reading

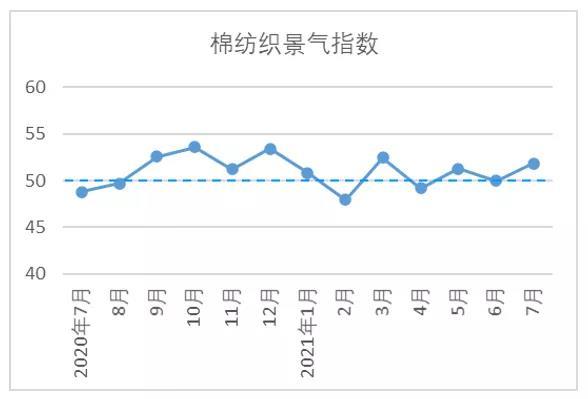

Market Analysis: Prosperity Report Of China'S Cotton Textile Industry In July 2021

|

2021/8/26 8:30:00

2

Zhejiang Puyuan, Guangdong Humen And Other Industrial Clusters Complete The Chain To Achieve Self-Sufficiency

|

2021/7/16 12:26:00

15

Textile And Garment Industry Weekly: Sports Brands Show Domestic Glory, 21Q1 Shows Strong Growth

|

2021/4/26 14:44:00

19

- regional economies | Japan'S Silk Trade Volume In July Was 107 Million US Dollars, Down 22.02% Year On Year

- Entrepreneurial path | "Eyes" And "Brain" Of Smart City

- Instant news | Four Textile Intangible Cultural Heritage Projects Were Selected Into The List Of 2021 National Cultural, Tourism, Scientific And Technological Innovation Project Reserve

- market research | The Power Of Brand: From Luxury Brand As A Century Old Brand In The Process Of Digital Transformation

- neust fashion | Fashion Trend: Spring And Summer 2023 Retro New Sports Theme Color Trend

- Professional market | Focus On The Development Of Futures Market: Actively Promote The Research And Development Of Carbon Futures And Serve Small And Medium-Sized Enterprises

- Financial management | Close Of Public Offering In 2021: The Total Profit Of The Fund Is 650 Billion Yuan, And The Matthew Effect Is Remarkable, And The Management Fee Increases By Nearly 70% Year On Year

- Gem | The Tide Of Lifting The Ban On Science And Technology Innovation Board Is Surging

- Listed company | The First Case Of Core Technology Held By The Actual Controller Of Science And Technology Innovation Board: Exclusive Response: There Is No Capital Injection Plan For External Shareholders

- Guangdong | Guangzhou Held A "Second-Hand House Reference Price" Big Move, Many Second-Hand Housing To Bubble

- Promote The Modernization Of Industrial Chain Development! The 4Th Standing Council Of The 8Th China Textile Machinery Association Will Be Held Soon

- 30 Years Of Jiang Fu · Dan Xin Pu | Adherent Of Chinese Painting Teaching -- Bao Mingyong

- Japan'S Silk Trade Volume In July Was 107 Million US Dollars, Down 22.02% Year On Year

- "Eyes" And "Brain" Of Smart City

- Four Textile Intangible Cultural Heritage Projects Were Selected Into The List Of 2021 National Cultural, Tourism, Scientific And Technological Innovation Project Reserve

- The Power Of Brand: From Luxury Brand As A Century Old Brand In The Process Of Digital Transformation

- Fashion Trend: Spring And Summer 2023 Retro New Sports Theme Color Trend

- Focus On The Development Of Futures Market: Actively Promote The Research And Development Of Carbon Futures And Serve Small And Medium-Sized Enterprises

- Close Of Public Offering In 2021: The Total Profit Of The Fund Is 650 Billion Yuan, And The Matthew Effect Is Remarkable, And The Management Fee Increases By Nearly 70% Year On Year

- The Tide Of Lifting The Ban On Science And Technology Innovation Board Is Surging