Boosted By The Favorable Textile And Clothing Export Data, Adding Confidence To The Cotton Market

Boosted by the positive textile and clothing export data, Zheng Mian hit the 15000 US dollars/ton mark again in the middle of the session on the 14th. Although the final cotton price fell back and only rose 0.2% in the day, the optimistic data from the demand side still boosted the market's confidence in the long-term improvement of the cotton market.

According to the data released by the General Administration of Customs on the 13th, in March this year, the total export volume of textile yarns, fabrics and their products in US dollars reached 12904.9 million US dollars, a sharp increase of nearly 86% month on month and 9.1% year on year; The total export of clothing and clothing accessories reached US $13484.9 million, an increase of nearly 78.6% month on month and 31.9% year on year.

The agency's analysis of the reasons for the sharp increase of textile and clothing exports in March compared with the same month on month is inconsistent. In the report, the reason for the sharp increase of textile and clothing export data in March was attributed to the low base effect in the same period of March last year and the backlog of orders from December to January last year due to the Spring Festival. On the other hand, "it is also due to the fact that international demand has indeed improved in the last two months, while China's exports to Southeast Asia and the countries along the" Belt and Road "have increased significantly."

In March, the increase of textile and clothing export book denominated in US dollars was "so out of place against the background that the market has been discussing poor export sales". To sum up the main views of the market, on the one hand, there are indeed some orders with delayed production in the early stage whose export data is fed back to March; On the other hand, a little demand for replenishment in overseas markets promoted domestic downstream production, making the domestic textile industry a relatively hot market after the Lantern Festival

According to the comprehensive market analysis, the textile and clothing export data in March eased the market's concerns about bad external demand. The USDA Outlook Forum predicts that the global cotton consumption in 2023/24 is expected to be 25.15 million tons, an increase of 1.177 million tons year on year.

Foreign consumption is not good on a year-on-year basis, but it is better than the market expectation. This expectation deviation is a potential benefit for the future market. In his opinion, the worst time of cotton consumption has passed, and the focus of the future market has gradually shifted to consumption recovery.

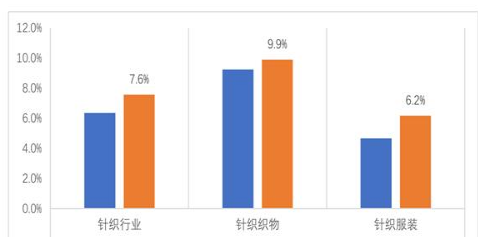

At present, the domestic cotton textile industry is still in the traditional peak season of "three gold and four silver", and the industry as a whole still maintains a positive development trend. In March, the purchasing managers' index (PMI) of China's cotton textile industry was 62.44%, down 2.31 percentage points month on month. Although it fell back, it was still above the boom and bust line for the fourth consecutive month. Among them, this month's production volume and operating rate index reached a historical high, enterprise output increased and sales were smooth.

Compared with the market's "suspicion" of overseas textile demand and the positive expectation of domestic textile demand, it successfully pushed the cotton price higher.

On the panel, since the Zheng cotton price hit a low of 12270 yuan/ton for more than two years in November last year, it has risen for three consecutive months. The center of gravity of cotton price has risen from 12000-13000 yuan/ton to 14000-15000 yuan/ton. In February and March this year, although cotton prices fluctuated, they remained at a high level for nearly half a year as a whole.

The market early warning expert committee of the Ministry of Agriculture and Rural Affairs said in the analysis report on supply and demand situation in April that the domestic economy has recovered steadily and improved, consumption has continued to pick up, domestic downstream textile and clothing consumption expectations have increased, and cotton sales have accelerated significantly. According to the data of the national cotton market monitoring system, as of April 6, the national sales rate of new cotton was 74.8%, 2.6 percentage points higher than that of the previous year. Considering that the cotton supply is generally sufficient, but the consumption in the international market is weak, the cotton price remains unchanged at the forecast value of last month.

When looking forward to the domestic cotton market in the second quarter, China's economic growth in the second quarter is expected to grow, domestic demand for textiles and clothing is expected to continue to rise moderately, and the corresponding cotton consumption is expected to grow. The industry is still cautious and optimistic about domestic demand expectations. The profit of cotton textile enterprises is fair, the starting load is expected to remain high, the cotton consumption is expected to remain at a high level in the first quarter, and the cotton procurement will maintain the strategy of purchasing on a single basis or bargain hunting.

In addition to the positive expectation of demand recovery, supply concerns and weather factors caused by the decline in global cotton planting intentions may boost the supply side of cotton prices.

Domestically, the factors driving the recovery of cotton prices last year were not only the rising demand, but also the decline of cotton planting area. The survey conducted by the National Cotton Market Monitoring System in the middle and late March 2023 shows that the intended cotton planting area in China in 2023 will be 43.891 million mu, a year-on-year decrease of 2.279 million mu, or 4.9%, of which the intended cotton planting area in Xinjiang will be 38.425 million mu, a slight year-on-year decrease of 893000 mu, or 2.3%. According to the China Cotton Association, the national cotton planting area in 2023 will be 42119600 mu, a year-on-year decrease of 3.7%. The decrease of yield, quality and planting income is considered to be the main reason for the decrease of cotton planting intention area.

From a global perspective, not only is China's cotton planting area expected to decline this year, but the data from the US Department of Agriculture shows that the US cotton planting area may decline by about 18% this year. By the week of April 4, the planting progress of American cotton was 4%, also lower than the historical average in recent three years.

Cotton is an important strategic resource. In order to stabilize cotton production and ensure the income of cotton farmers, since 2014, the state has implemented and continuously improved the cotton target price policy in Xinjiang, and established a long-term target price mechanism. In particular, the target price policy for cotton in Xinjiang will be improved from 2020. The target price level is 18600 yuan per ton, which will be evaluated every three years. According to the announcement of the National Development and Reform Commission on the 14th, with the consent of the State Council, the target price of cotton in 2023-2025 will be 18600 yuan per ton. At the same time, we will improve the implementation measures, focus on improving cotton quality, promote the construction of a unified cotton market in Xinjiang, and improve the supporting institutional arrangements.

Looking forward to the future, in the context of optimistic future cotton market demand, institutions are generally optimistic about the medium-term cotton price.

Shenyin Wanguo Futures believes that the data of downstream textile enterprises of Jin, San, Yin and Four turn better, the operating rate remains at a high level, the finished products are shipped well, and the current cotton yarn and grey cloth inventory is at a historical low level. On the whole, driven by the decline of planting area and the recovery of domestic demand, the center of gravity of domestic cotton prices is expected to move up gradually.

Jinshi Futures also said that the textile and clothing exports in March were in good condition, and the cotton price trend in the domestic market was stable. The short-term peripheral macro sentiment, US cotton market and domestic planting intention in the new season will be the focus of the market in the future. It is expected that the cotton price will maintain a strong shock, and in the medium and long term, the price is expected to rise in the center of gravity. We will continue to focus on whether the downstream order changes can improve.

- Related reading

Market Analysis: The Global Textile And Clothing Market Generally Has Confidence In The Textile Industry In The Middle And Lower Reaches Of The Industrial Chain

|

Analysis Of The Basic Situation Of Cotton Market In The Face Of The Global Situation

|

Securities Trader Report: China'S Leading Apparel Enterprises Showed A Significant Growth Trend In February

|- Dress culture | The Transformation And Upgrading Of Red Bean Group Has Been Accelerated Again With Frequent Highlights

- Bullshit | CDG PLAY X Converse Pro Leather Co Branded Shoe Design

- I want to break the news. | Brain Dead x Oakley Factory Team 联名新鞋款设计鉴赏

- Bullshit | Stan Smith Shoe Design Of Y-3 Version

- News Republic | Re Pick The Honor Of "National Brand" Red Bean Group Won The "National May Day Labor Award"

- Guangdong | Shantou Releases Patent Navigation For Textile And Garment Industry

- I want to break the news. | A Return Visit To The "Textile Light" Science And Technology Award Project To Witness The Advancement Of Scientific And Technological Innovation Of Chemical Fiber Enterprises

- I want to break the news. | Get Up! Nanchong Printed And Dyed Fabrics Are Sold Overseas

- Bullshit | 打造户外产业新生态!中国纺织户外产业发展大会在信阳举办

- I want to break the news. | 五一开业 预祝三年七班四店开业大吉 生意兴隆!

- [Attention] Notice On Improving The Implementation Measures Of The Cotton Target Price Policy

- Dressing: Do You Know The Prototype Of The Shirt

- Salomon Cooperates With Gramicci To Create Tracy Shoes TECHSONIC FOR GRAMICCI

- The Runway Of China International Fashion Week: Chinese Aesthetic Beauty Lies In Culture

- The Runway Of China International Fashion Week: Chinese Aesthetic Beauty Lies In Culture

- BOC Cashmere (000982): Net Profit Decreased By 74.86% In 2022

- New Material: Researchers At The University Of Massachusetts Amherst In The United States Imitate Polar Bear Fur To Make Thermal Fabric

- Experience Of Brazilian Cotton Entering New Markets Planting Medium Fiber Cotton

- Industry Observation: Cotton Planting Area In Turkey Is Expected To Decrease After The Earthquake

- Fashion Duel Field! The Final Of The 8Th "Puyuan Cup" PH Value China Knitting Designer Competition Was Staged In Puyuan Ancient Town